malaysia payroll tax

Employees will need to pay monthly contributions by the 15th of the following month. The amount paid by employees varies depending on income and employers pay 175 of payroll every month.

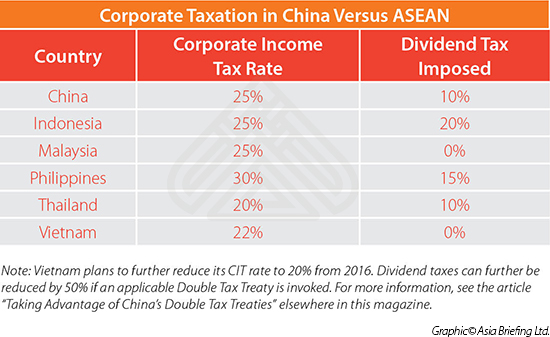

Asiapedia Corporate Taxation In China Versus Asean Dezan Shira Associates

Ad Alle voordelen van payroll gecombineerd met alle andere voordelen van Maqqie.

. Malaysia follows a progressive tax rate from 0 to 28. Tax Law in Malaysia For both resident and non-resident companies operating in Malaysia corporate income tax will be imposed on income that accrued from within Malaysia. The fiscal year in Malaysia starts from 1st January to 31st December.

Employer Payroll Contributions 1200 - 1300 Provident Fund employees under the age of 60 400-650 Provident Fund employees over the age of 60 175 Social Security SOCSO 020 Employment Insurance EIS monthly salary ceiling of 5000 MYR 100 Human Resource Development Fund over 10 employees 1895-2245 Total Employment Cost. Each employee will need to file their taxes for each calendar year before 30th April. Alternatively you may change the Calculate For option to Bonus Only this will show the exact amount of statutory contributions for the bonus component only.

For instance January contributions need to be paid no later than the 15th of February. Employers must maintain an employee register with relevant payroll information for each staff member. Youll still need to pay taxes for income earned in Malaysia and will be taxed at a different rate from residents.

Petrol allowance petrol card travelling allowance or toll payment or any combination. For the same employee monthly PCB for salary alone will be RM 130 so the tax for bonus is RM 650 - RM 130 RM 520. Contribution Rate EPF Contribution Rate Note.

Employment cost simulation for Malaysia is an estimate based on the companys local taxation and compliance. Met payroll heb je geen zorgen meer over ziekte en andere werkgeversrisicos. How many income tax brackets are there in Malaysia.

Under Tax Details ModuleEnter the HRDF contribution rate 1 or 05 as per applicability. Jadual PCB 2020 PCB Table 2018. It won the Best Payroll Software award trusted by Fortune 500 and multinational corporations across Asia Australia Middle East Africa United Kingdom and more.

Parking rate or parking allowance. Income Taxes in Malaysia For Non-Residents. Hire.

Ramco is considered the best payroll software in Malaysia and other parts of the world. Regardless of residency or citizenship all workers in Malaysia are required to pay tax. AYP Group has all the information Payroll Working hours Leave etc you need before hiring your Malaysia employees.

This income tax calculator can help estimate your average income tax rate and your salary after tax. RM3000 RM250 1 RM3250 How is HRDF applicable on Deskera People. An individual is a non-resident under Malaysian tax law if heshe stay less than 182 days in Malaysia in a year regardless of hisher citizenship or nationality.

Tax exempt as long the amount is not unreasonable. Thats a difference of RM1055 in taxes. The tax year in Malaysia runs from 1st January to 31st of December.

With Deskera People as an employer you can enter the relevant HRDF percentage of contribution following the few simple steps. Employer Payroll Contribution. Employees are eligible for an income tax relief of MYR250 per annum for SOCSO contribution.

Provident Fund employees under the age of 60. You are regarded as a non-resident under Malaysian tax law if you stay in Malaysia for less than 182 days in a year regardless of nationality. The personal income tax rate in Malaysia is progressive and ranges from 0 to 30 depending on your income for residents while non-residents are taxed at a flat rate of around 30.

Ad Door het werkgeverschap uit te besteden kun jij je focussen op ondernemen. Monetary payments that are subject to SOCSO contribution are. Malaysia has a monthly tax deduction MTD system requiring employers to deduct withholding tax at sourceEach month employers must then send this tax to the Inland Revenue Board IRB of Malaysia on behalf of their employees.

Corporate taxes are set at 24 for the majority of businesses. Please note effective from Jan 2021 wages until December 2021 wages the contribution rate was reduced from 11 to 9 for employees aged under 60. The highest rate of tax on personal income is 30 which is the rate for income exceeding MYR 2000000.

However an employee can maintain their contribution rate at 11. Tax for Non-Residents is currently a flat 30 whereas tax for residents is on a sliding scale from 0 to 30 dependent on which income grouping you fall into. Ad Door het werkgeverschap uit te besteden kun jij je focussen op ondernemen.

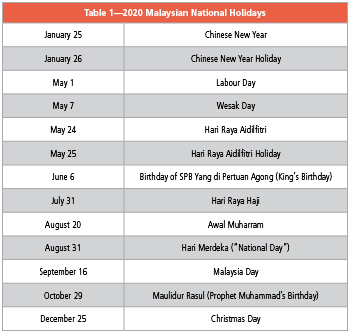

Malaysia is Malaysia is a Southeast Asian country that lies just north of the equator. GET IN TOUCH PEO in Malaysia Countries CONTACT US TODAY Discover More Solutions in Malaysia FAQs. Ontvang snel de Scherpste offertes van de beste Payroll bedrijven in uw Regio.

Employer Payroll Tax Employee Payroll Tax Employee Income Tax Employee entitlements and terminations. Tax exempt up to RM2400 per year. Includes payment by the employer directly to the childcare provider.

All tax residents as well as non-residents employees who work between 60-182 days per year in Malaysia are required to pay tax capped at 30 for income more than MYR 2000000. Includes payment by the employer directly to the parking operator. The current corporate tax rates are as follows.

The standard rate of VAT in Malaysia is 1000 for sales tax 600 for service tax. A non-resident individual is taxed at a maximum tax rate of 28 on income earnedreceived from Malaysia. If the contribution is maintained at 11 the EPF Contribution Table applies.

Ontvang snel de Scherpste offertes van de beste Payroll bedrijven in uw Regio. Met payroll heb je geen zorgen meer over ziekte en andere werkgeversrisicos. Onboard Work.

Enter HRDF Rate 2. Ad Payroll prijzen voor elke branche vergelijk vrijblijvend de Beste offertes. 13 rows A non-resident individual is taxed at a flat rate of 30 on total taxable income.

Employers in Malaysia must withhold employees monthly tax contributions - at rates ranging from 0-28 depending on salary amount. The maximum income tax rate in Malaysia is 30 which applies to those with incomes greater. Under Malaysian tax law those classified as non-residents are individuals who work in Malaysia for more than 60 days but less than 182 days in a year.

A qualified person defined who is a knowledge worker residing in Iskandar Malaysia is taxed at the rate of 15 on income from an employment with a designated company engaged in a qualified activity in that specified region. Neem vrijblijvend contact op of vraag direct je Payroll Offerte aan. Ad Payroll prijzen voor elke branche vergelijk vrijblijvend de Beste offertes.

Individual Income Tax In Malaysia For Expatriates

7 Tips To File Malaysian Income Tax For Beginners

How To Sell Online Payslips To Your Employees Payroll Payroll Template Things To Sell

Confluence Mobile Support Wiki

Tax Season Is Coming Malaysia Business Income Tax Deadlines For 2022

7 Tips To File Malaysian Income Tax For Beginners

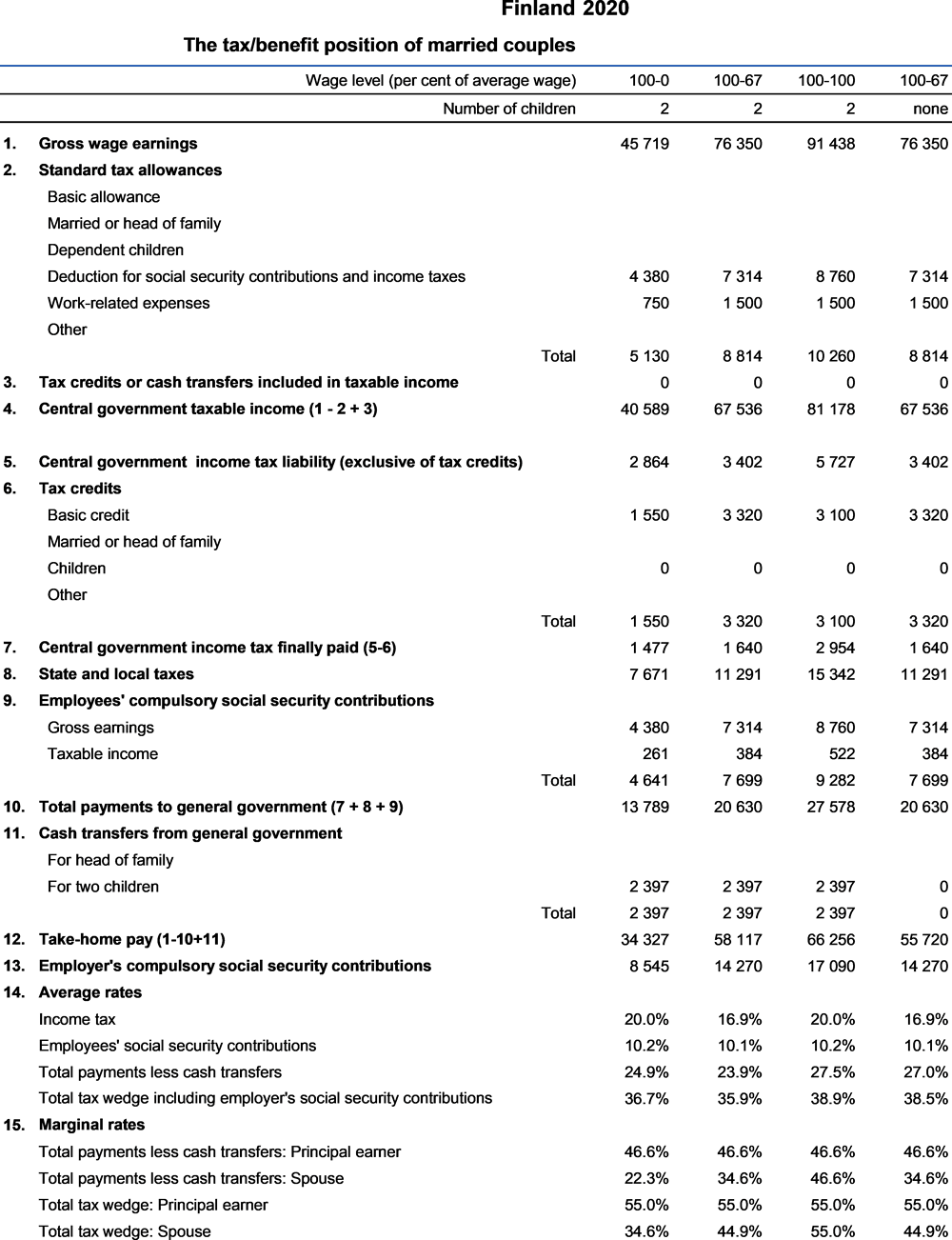

Finland Taxing Wages 2021 Oecd Ilibrary

Abss Payroll V11 What S New Abss Accounting Malaysia

Everything You Need To Know About Running Payroll In Malaysia

Personal Tax Relief 2021 L Co Accountants

Person St Partners Plt Chartered Accountants Malaysia Facebook

Deadline For Malaysia Income Tax Submission In 2022 For 2021 Calendar Year L Co

Deadline For Malaysia Income Tax Submission In 2022 For 2021 Calendar Year L Co

Malaysian Tax Issues For Expats Activpayroll

Cukai Pendapatan How To File Income Tax In Malaysia

What You Need To Know About Payroll In Malaysia

Ease Of Doing Business Singapore Vs Malaysia Rikvin Pte Ltd

Malaysian Bonus Tax Calculations Mypf My

How To Calculate Foreigner S Income Tax In China China Admissions

Comments

Post a Comment